17 February 2023

The significant cost of private education is too frequently underestimated; while the fees for the education itself are rising, the everyday expenses associated with this type of schooling are also proving to be a significant outgoing for families across the UK.

This blog post will outline the considerations that need to be made when factoring private education into household budgets, drawing on the expertise of our Wealth Planning team and independent research from our Wealth Transfer Report.

Private school education can offer children significant benefits over state schooling. From smaller class sizes to a broader curriculum and a focus on the holistic development of the child, a private education arguably provides a child with a better foundation for excelling in their chosen field. Not only that, but private schools are more likely to offer a wider range of extracurricular activities while ensuring students have access to state-of-the-art facilities, which can go some way to helping them secure a place at their desired university. The community spirit encouraged by private schools can also lead to lifelong friendships and open doors for new and diverse experiences.

We often find that private school education is a popular financial ambition for our clients and can help families identify options to fund this, from intergenerational wealth transfer to cash flow planning. Regardless of how you fund private schooling, it is critical to understand the true cost to ensure that your ambitions are achievable and family budgets are manageable.

Please note: the services we introduce in this blog post are likely to involve an element of investing. As is the nature with all investing, your capital is at risk, and you may not receive back the same amount you put in when you choose to cash out your savings.

William Stevens

Partner, Head of Financial Planning

What is the cost of private school education in 2023?

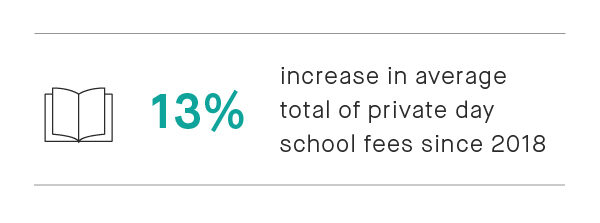

While family budgets of all sizes are stretched tighter than ever due to the rising cost of living, inflation is also having an impact on private school fees.

Industry figures show that parents of children at private day schools pay average annual fees of £15,654 [1] – an increase of 13% on the 2018 average of £13,854.

What additional expenses do I need to consider?

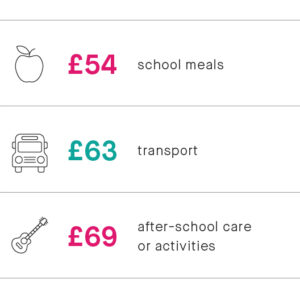

There are a wide range of additional costs associated with a private school education. From everyday expenses like school meals and transportation, to one-off expenses like school trips and equipment for extracurricular activities, such as sports equipment or musical instruments.

School meals for example, cost on average £54 per week, which works out to £216 per month (per child) [2].

Further to this, you should also factor less frequent expenses like uniforms, books, and school equipment into your budget, as these are likely to be significant and will often demand immediate payment.

Considering the increase in school fees since 2018, it would not be surprising to see these costs rising over time too, therefore it is important to plan your finances with future increases in mind.

What additional impact will private school education have on my lifestyle?

It is common for families to have factored school fees and everyday expenses into their financial plans but not have considered the additional impact this will have on their wider lifestyle.

For example, private schools typically have shorter terms than state schools, which means you may need to arrange for wrap-around childcare or holiday clubs. This can also lead to increased costs for meals and transportation, especially if the child needs to stay away from home for longer.

Families may also wish to employ tutors and coaches to support children outside the classroom, or for extra-curricular activities such as drama, music and sport. Each of these activities has their own expenses, and these costs can quickly add up.

How much do I need to fund private school education in 2023?

As this blog post illustrates, private school education is a significant expense. The total cost can add up quickly, and you may have found that you need to budget more than you had initially expected.

While the actual cost will vary based upon individual circumstances, industry figures suggest this would be over £20,000 per child for school fees and everyday expenses alone.

Annual cost of private school education in 2023 [3]

| Cost | One child | Two children |

| School fee | £15,654 | £31,308 |

| School meals | £2,106 | £4,212 |

| Transport | £2,457 | £4,914 |

| After-school care or activities | £2,691 | £5,382 |

| Total | £22,908 | £45,816 |

It is important to note that this calculation only covers school fees and everyday expenses, and there are likely to be additional expenses that arise in support of the ambitions you have for your children.

Request a copy of our wealth transfer report here

How we can help with your ambitions for a private school education

We frequently assist families with building detailed plans to support them with their financial ambitions. Whether this is to fund education, start a business or save for later in life, our Wealth Planning experts have decades of experience in helping families to plan their finances effectively*.

One of the ways we assist families with their ambition to fund private education is by supporting each generation in understanding the most effective means to transfer wealth, which can be a tax-efficient^ way of making an investment into your family’s future. Another service we offer is cash flow planning, which helps you to visualise where you will financially end up in the future and can help ensure you are taking advantage of any opportunities to make your money go further.

To find out more about our Wealth Planning services or for assistance saving towards ambitions like sending your children to private school, you can visit one of our locations or speak to an Adviser.

* The services introduced in this blog post are likely to involve an element of investing. As is the nature with all investing, your capital is at risk, and you may not receive back the same amount you put in when you choose to cash out your savings.

^Please note, the tax treatment depends on the individual circumstances of each client and may be subject to change in the future.

[1] Source: Census and Annual Report, ISC, 2018-2022

[2] Figures based on a 20-day month

[3] Figures based on an average of 39 weeks in an academic year