01 July 2025

Parents often wish to leave a financial inheritance for their children, but what should that look like, and what else should you consider for an effective transfer of wealth?

Identifying the right amount, the right time, and the right way to leave a financial inheritance is essential to good intergenerational planning; it can be the foundation that enables the sort of transformative experience every parent wishes for their child.

William Stevens

Partner, Head of Proposition Management

However, ending your planning once you have decided how to make the gift could leave a lot of value on the table and unwittingly contribute to future financial troubles.

Effective financial inheritances have three parts: the gift itself, knowledge of how to manage it and the mindset for how to live with it. The key to passing on all three successfully is to be proactive about discussing financial literacy with your children.

But as you will likely be aware, intergenerational discussions are often challenging. Even with the best intentions, your child may not receive the advice you share in the spirit intended.

This blog post will discuss how you can help children develop financial literacy and introduce financial concepts in a way that is likely to stay with them for life.

Our Financial Roadmap is a preliminary cash flow model; a projection of income, assets and expenditure during your lifetime, based on certain assumptions such as investment growth and inflation.

Capital at risk

Capital at risk

Please be aware that the value of your investments may fall as well as rise. The content of this blog post reflects our current understanding of UK legislation and only impacts those within the UK tax system. Tax treatment depends on personal circumstances, and the rules may be subject to future change.

Growing a smart financial mindset

The journey around the formative corner from adolescence to adulthood is the best and the worst time for a child to receive a financial windfall.

While a financial boost at this age can open up possibilities to explore various dreams and opportunities, it could also result in your child learning an expensive lesson.

One of the best ways to set a child up to make sound financial decisions is to focus on helping them develop a savvy mindset. While educating them on concepts like market cycles and diversification are still helpful, understanding the benefits of saving for a rainy day is more likely to cause them to think twice before impulsively withdrawing their savings

Our Financial Roadmap is a preliminary cash flow model; a projection of income, assets and expenditure during your lifetime, based on certain assumptions such as investment growth and inflation.

Start talking about money early

Helping your child understand how you make financial decisions can be helpful at a young age, from sharing about the cost of groceries to setting money aside for higher-value purchases. The ideal age to start talking about money will depend on your family’s circumstances, but we recommend doing this many years before they can legally manage their savings or investments. While youthful brains may be highly malleable, they do not change instantly and may take years to grow to financial maturity.

Encourage questions to aid their education

Unless your child is already interested in it, the technical knowledge or money management rules you share could go in one ear and out the other. While it is tempting to think of financial literacy as something you can teach by sharing a guide or other educational content, it pays to remember that brains need to care about something before they adapt to accommodate living with it. For example, suggesting 'Saving is a good idea' will likely have to pass through several rounds of a child asking ‘Why?’ before it becomes personally relevant to them.

More ways to build a financial inheritance

Raising financially literate children requires more than just handing them a gift and trusting they will make sound financial decisions; it also needs to be supported by the knowledge of how to spend the money and a sound financial mindset.

Regardless of how you plan to build a financial inheritance, our services can help you generate and protect wealth - from taking advantage of tax-efficient investing opportunities to creating a comprehensive financial plan that maps out key moments over your lifetime. All of this means you can rest assured that when you combine your educational efforts with your own smart financial decisions, you can leave your loved ones with a firm financial foundation for the future.

Consultation

Our Wealth Planners regularly help clients develop strategies to achieve their financial goals, from maximising pension contributions to forecasting how much you will need to save for retirement. Get in touch to book a consultation with one of our Wealth Planners (the first one is free) and learn how our Wealth Planning Service could help you structure your family finances more effectively.

A Killik & Co client story: when is it best to begin financial education?

‘Isaac’s going to be 13 next month,’ said Craig, his father, at our latest planning meeting. ‘I know we said when we started the JISA savings plan that this was around the time when it may be best to tell him about it, but he still seems so young, and it’s not like he can do anything with it yet.’

‘We’re starting to wonder,’ added Ruth, Isaac’s mother, ‘if it’s better waiting until he’s legally responsible for managing it.’

‘You can, of course, and plenty of parents do. Although, I’d encourage you, if you do tell him about the fund now, to get Isaac to write down what he’d spend the money on could he do so now. And then repeat the exercise next year. And again each year, indefinitely.

‘This will likely prove a powerful means of demonstrating several things: how what we want most can change completely in a relatively short time, and, assuming at least a moderately typical period of returns, a vivid demonstration of how much can be accumulated with regular savings and compound growth.’

‘Yes, I see what you mean, said Craig. ‘And we’ve always been clear that we’d like Isaac to view most, if not all, of his JISA money as the start of a much longer-term investment. You’ve got me thinking that we’re far more likely to achieve that aim by using its existence as a reason to learn about some basic principles of investing, than by telling him it’s there on his 18th birthday, but not to touch it. But I’m still not sure how best to broach it.’

‘I agree. I also remember what you’ve often said about gifting money in general, how you want to give him “enough so that he can do anything, but not so much that he can do nothing”. You could frame your discussions around this idea: that the fund is a means of supporting him as he explores opportunities to do whatever interests him most, making it clear that you’re not suggesting any particular way, but you are discouraging the “nothing” way.'

Disclaimer

Disclaimer

This client story is for illustrative purposes only. The use of Killik & Co’s services does not guarantee similar outcomes, as investment results will vary based on individual circumstances. The value of investments can go down as well as up, and you may not get back the amount originally invested. Tax rules and regulations are subject to change and may affect your investments.

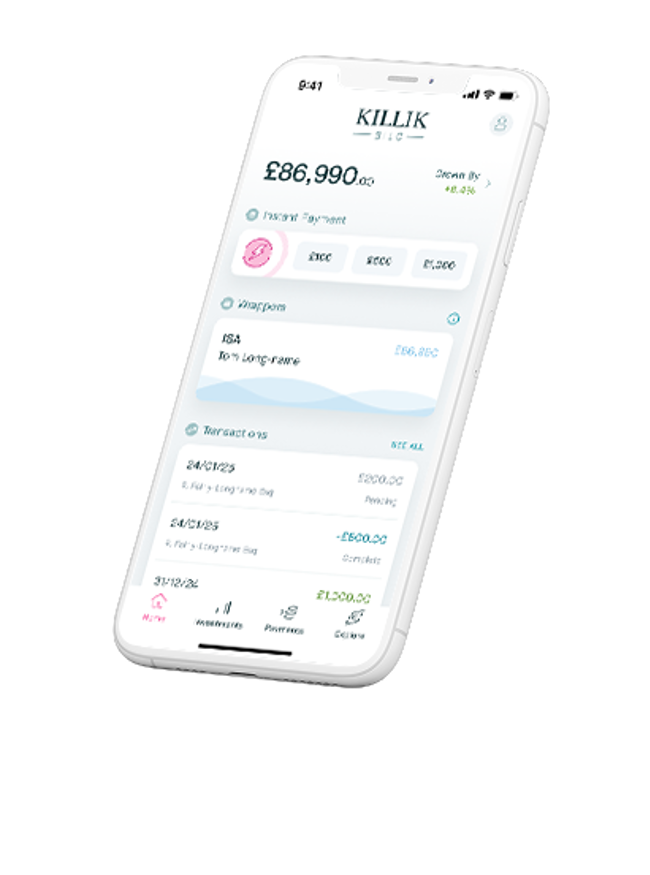

Open a Junior Stocks & Shares ISA with our digitally led investment service Silo

Our app gives you the tools to save and invest, little and often, with intelligent features and no minimum investment requirement.