Investing versus cash, and the need to beat inflation

Investing is the process of putting your money into assets, with the expectation that they will grow over time. The investment strategy you choose and the time horizons you invest for, have a bearing on your target level of risk versus return, but the value may rise and fall, and depending on when you need to access your assets, you may not receive back the same amount you put in.

Cash is a type of asset, but it is one of the least risky assets. You may be able to grow your cash savings by shopping around for a good interest rate, often improved by locking in your cash for a fixed period.

One risk of holding cash is Inflation. Inflation is the rate at which prices for goods and services are rising. If inflation is higher than the interest rate you are earning on your cash savings, then your purchasing power for goods and services becomes lower, meaning your money will now buy you less than it previously would have.

Investing can help you to beat inflation. Over the long term, stocks and shares have historically outperformed cash.

"Someone is sitting in the shade today because someone planted a tree a long time ago."

Warren Buffett

Capital at Risk

Capital at Risk

You may get back less than you invest. Past performance is not an indication of future performance. The tax treatment depends on the individual circumstances and subject to change in the future.

How much could my savings be worth?

For illustration purposes only, assuming annual compound interest, ignoring inflation. Forecast is not an indicator of future growth, which depends on the performance of chosen investments. Capital is at risk and past performance is not a reliable indicator of the future.

Investing for children and investing for long-term growth

One of the biggest advantages of investing for children is that you have a long time horizon. This means that you can afford to take on more risk in your investments in pursuit of higher returns, as you have more time to ride out any short-term market fluctuations.

You can read more about the benefits of compounding here.

How a little and often approach might be better than trying to time the market

Trying to time the market is very difficult, and even professional investors can fail. An alternative approach is to invest a little and often. This means that you can smooth out market volatility by investing at different points (i.e., catching the lows and highs, which average out).

This can help you to reduce your average cost per unit and improve your overall returns. See what your savings could look like over time, with our Savings Calculator.

Why would you want a Junior ISA?

There are a number of reasons why you might want to open a Junior ISA for your child.

- First, Junior ISAs are tax efficient. Any contributions you make to a Junior ISA are free of income tax and Capital Gains Tax. This means that your child’s money can grow faster over time.

- Second, Junior ISAs offer you a great deal of flexibility. You can choose to invest in a range of different assets, and you can change your investment strategy at any time.

- Third, Junior ISAs are relatively easy to set up, manage and transfer, with little or no cost for the ISA wrapper. You can open a Junior ISA with most major banks and investment providers. At Killik & Co, we offer options to invest into a Junior ISA, either through our app-only investment service or through a range of services that include access to one of our Investment Managers.

Current tax rules allow you to invest up to £9,000 per tax year, per child.

Once a child turns 16, they can take control of the account, but they cannot withdraw the funds until they are aged 18. At this age, the savings can be rolled into an Individual Savings Account (ISA) where the money can continue to benefit from long-term growth with the same beneficial tax treatment.

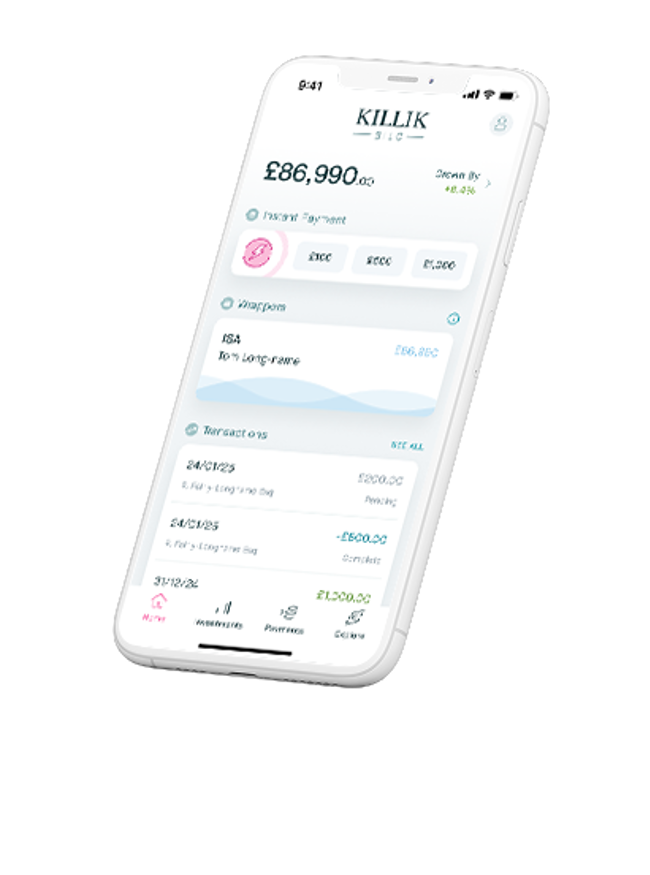

Introducing the Silo Investment Service

The Silo Investment Service is Killik & Co’s new and improved digital-first discretionary offering, that gives clients the benefits of expert-led investment, innovative technology and flexible payments, all through the Killik App.

What is a Junior SIPP and why might you want one for your child?

A Junior SIPP is a type of pension that is designed for children. It is a tax-efficient way to save for your child's retirement.

Contributions to a Junior SIPP are free of income tax and you can even get tax relief from the government. The money in a Junior SIPP can be invested in a range of assets, including stocks and shares, funds, and bonds.

Once your child reaches retirement age, they can access the money in their Junior SIPP. They can choose to withdraw the money as a lump sum or as an income.

Current tax rules allow a maximum investment of up to £3,600 per tax year, per child. This means investors can contribute up to £2,880 each year, with £720 paid automatically by the government. See what your savings could look like over time, with our Savings Calculator

We have a range of Killik Explains educational videos on this subject of investing for children

Enquire today

Conclusion

Investing for children can be a great way to give them a head start in life. By saving and investing for them early on, you can help them to achieve their financial goals, such as buying a house or paying for university.

If you are considering investing for your child, then there are a number of different things you need to think about, such as the type of investment account you want to open, the assets you want to invest in, and your risk tolerance.

It is important to do your research and if necessary, to seek professional advice before making investment decisions. Alternatively, we offer a fully managed service through our investing app Silo, or you can arrange a free consultation with one of our Investment Managers.