Capital at Risk

Capital at Risk

Any money you invest is at risk and the value can rise and fall. Information on this page is general guidance, not individual advice.

What are the different types of Investments?

There are many different types of investments, such as stocks (also known as shares or equities), bonds, funds, and real estate, and each comes with its own risks and rewards.

Stocks offer some ownership in a company, bonds are loans that you make to a company or government, real estate covers land and buildings. Funds are a way of pooling money from many individuals, which can be invested in a wide range of shares and/or bonds collectively. And there are a whole host of other options besides.

Picking the right investment for your needs can be a complex process, so it’s important to educate yourself and/or seek professional advice before making any decisions.

“In other words, it can help you to live well and to leave a good legacy to your family.”

Tim Bennett

How much should you invest?

While choosing how much to invest is a personal decision, we like to use a three-pot approach after considering your day-to-day expenditure.

The first pot is a “Rainy Day” figure of 3-6 months’ worth of expenditure to cover an emergency fund or period without income.

The second is to cover any large, planned expenses, such as the purchase of a car or holiday.

Anything left over should be considered as part of your lifetime savings, that you could look to invest.

What are your time horizons?

Your investment time horizon is the amount of time you plan to keep your investments.

If you are investing for retirement, you may have a time horizon of 20 years or more. If you are investing for a down payment on a house, your time horizon may be five years or less. We typically suggest investing for the long term, and no less than five years.

Risk and return

All investments carry some degree of risk. The higher the potential return, the higher the potential risk. Before you start investing, it is important to understand your risk tolerance based on your financial goals, investment time horizon and overall financial situation.

Diversification

Diversification is the process of spreading your money across different types of investments, sectors and geographies. The purpose of diversification is to reduce your level of investment risk and the effects of one investment performing poorly.

Enquire today

How to invest

There are various ways to invest. You can either use DIY platforms that allow you to trade online, or opt for execution-only services where a broker can transact based on your instructions.

Alternatively, you may choose discretionary (also known as managed) services where you delegate decision-making to a professional on your behalf. Finally, and less common now, there are also Advised Services (i.e., you have access to professional advice but you also have ultimate control of the decisions).

While we offer one form of all three options, a Managed service can be a good option during the early years of investing, or for those who lack the time or interest in being hands on with the decision making within their portfolio. We offer beginners a choice of either Investment Manager-led or App-only, managed services.

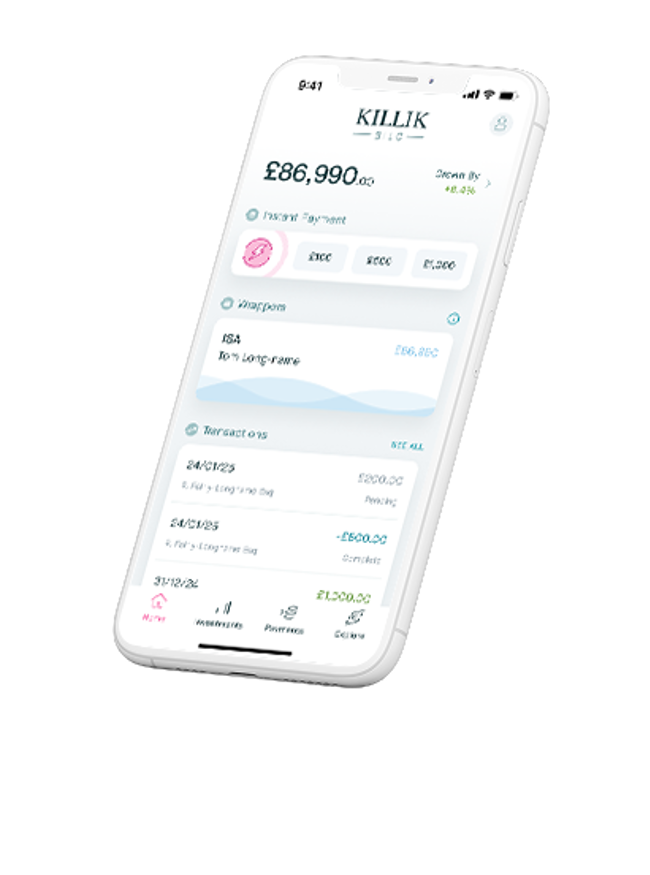

Our investing app service

Our app-only service, Silo can be a great option for newer investors or those looking to contribute smaller amounts regularly into an ISA, Junior ISA or General Investment Account.

Anything you save into the app is invested on your behalf, into one of several low-cost funds, based on your objectives and attitude to risk. Funds offer a convenient and efficient way to invest in a basket of well-diversified investments.

“A Managed service can be a good option during the early years of investing, whilst building knowledge and experience.”

Mike Pate

Guidance

Guidance

All information here is general guidance, rather than personal advice and offers a light touch overview, rather than an exhaustive guide for decision making.

Investment costs

There is no one-size-fits-all approach when it comes to fees, but it is important to understand them when comparing options.

You might need to pay a platform fee, a broker fee to trade, or a commission percentage and management fee. If you are invested into a fund, there will be separate costs for the external Fund providers. Even platforms that advertise ‘no commission’ have to cover costs and make a profit, and they sometimes do this by buying at a higher cost than they pay, and selling a lower cost than they are paid, in order to make money on the spread (the difference).

Always look at costs and ask for an explanation if they are unclear, as costs need to be offset against any gains from your investments.

Investment scams

Unfortunately, there are many investment scams out there. It is important to be aware of these scams and to avoid investing in anything that you do not fully understand. Also, beware of anything time sensitive or anyone trying to rush you into a decision.

Additional tips for first time or would-be investors

- Start small. You don’t need to invest lots of money to get started and even small amounts each month can add up over time.

- Invest regularly. One of the best ways to invest is to invest regularly, such as on a monthly basis. This approach can help to take advantage of pound-cost averaging, which involves buying when the market is both high and low. This can reduce the impact of market timing, which is notoriously difficult to predict.

- Don’t panic sell. The stock market can be volatile, but it is important to remember that the market has historically trended upwards over time. Don’t panic sell your investments if the market takes a downturn.

- Rebalance your portfolio periodically. A managed service will take care of this but if you manage your own investments, it is important to rebalance your portfolio to ensure that it still meets your investment goals and risks.

We have a range of Killik Explains educational videos on this subject.

Sign up to receive the latest news from Killik & Co, including our Market Update and Killik Explains educational videos, and be one of the first to hear about upcoming events and webinars. You can unsubscribe at any time and learn how we use your data in our Privacy Policy.

Sign me up to the latest emails from Killik & Co. We will not share your details with anyone else and you can unsubscribe at any time by clicking “change preferences” at the bottom of our emails.

Past Performance

Past Performance

Past performance is not an indication of future performance. The tax treatment depends on the individual circumstances of each client and may be subject to change in the future.

Concluding thoughts

- Consider the benefits of professional investment management or financial planning advice for complex situations or larger sums.

- Tax wrappers, such as ISAs, protect your investment earnings and gains from taxes.

- Take a look at our Killik Explains library and YouTube playlists for a wealth of video content on all sorts of specific investment and planning topics.

- Subscribe to our email newsletters for the latest market updates, suitable for investors of all levels.

- Try our Savings Calculator tool.

“ISAs can protect any earnings or gains on your investments from tax”

Will Stevens

Introducing the Silo Investment Service

The Silo Investment Service is Killik & Co’s new and improved digital-first discretionary offering, that gives clients the benefits of expert-led investment, innovative technology and flexible payments, all through the Killik App.